Trust Registration

Grow Start Initiate Your Business With Us

A trust can be for the benefit of a closed group or persons, known as a Private Trust, or for the public at large, known as a Public Trust. We advise and assist in Trust Registration, which is mandatory anywhere in India.

Start Your Company Without Any Hassel

Get Quote Instantly in a Minute

Introduction

Trust Registration

The Indian Trusts Act, of 1882, defines a trust as an obligation, annexed by the ownership of property, arising from a confidence reposed in the owner and accepted him, for the benefit of another owner or another person known as its beneficiary. In simple words, the owner of the property/assets called the ‘author of the trust’, entitles its ‘trustee’ to hold his property/assets for the benefit of other authors and beneficiaries. For this purpose, we can say that the ‘author of the trust’ has reposed his confidence in the Trustee. The beneficiary’s rights against the trustee as the owner of the property/assets is termed as his ‘beneficial interest’ in the Trust.

Benefits

Benefits of Trust Registration

Charitable Endeavors

Charitable trusts promote philanthropic endeavors to make a positive impact on society. You can enjoy tax benefits on your personal contributions to registered trusts.

Continuity and Perpetuity

Trusts can exist in perpetuity, allowing you to create a lasting legacy. Through trust registration, you can ensure the continuity of your objectives beyond your lifetime.

Tax Benefits

Trusts being non-profit entities are subject to many tax exemptions under the Income Tax Act. The exact provisions may vary based on the type of trust and jurisdiction of registration

Succession Planning

Trusts are excellent tools for succession planning. By transferring assets into a trust, you can outline specific instructions for their distribution to beneficiaries.

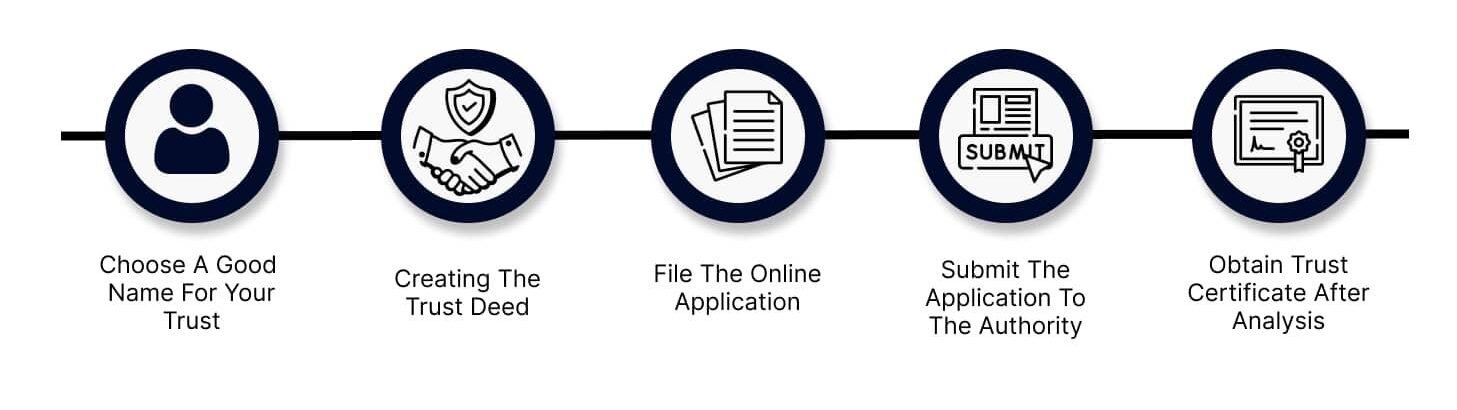

Process

Trust Registration In 5 Easy Steps

Document Checklist

Documents Required for Trust Registration Online

ID Proof

ID Proof Of Trustee and Trustor

Bills

Copy Of Utility Bills

12A and 80 G Certificate

From the respective income tax authorities to claim any form of deductions.

Address Proof

Address Proof of the Registered Office of the Trust.

Photographs

Two Photographs of the parties in the trust.

PAN Card

PAN Card of the individuals having a trust.