Startup Tax Exemption - 801AC

Grow Start Initiate Your Business With Us

Newly established and incorporated startups often face a shortage of financial resources during their initial stages of operations, which further has a negative impact on their sales and profits.

Start Your Company Without Any Hassel

GNGP Chartered Accountants is an online business compliance platform that helps entrepreneurs and other individuals with various, registrations, tax filings, and other legal matters.

Get Quote Instantly in a Minute

Introduction

Startup Tax Exemption - 801AC

Section 80IAC of the Income Tax Act 1961 is a special section in respect of the specified business. It came into effect on 1st April 2017. According to this section, an eligible assessee that is making profits can claim 100% tax deductions for any three consecutive years. People commonly refer to it as an 80IAC deduction for eligible startups.

The aim of this provision is to decrease the evasion of taxes. As a result, this tax benefit encourages young entrepreneurs in India to become honest taxpayers.

Who can apply for 801AC tax exemption?

- You have your DPIIT certificate;

- You have your DPIIT certificate;

- You can claim tax deduction for any three consecutive years out of the first five years of incorporation; and

- The startup claiming 80 IAC tax exemption has to be an original entity, not formed after a split or reconstruction of an existing business.

Benefits

Benefits Of Start-Ups Under Start-Up India Scheme

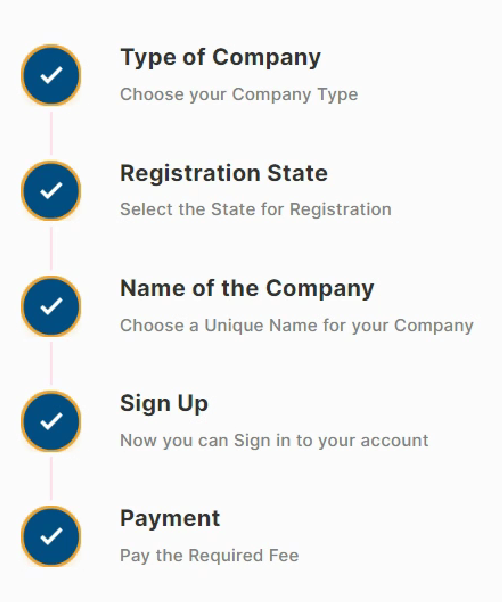

Process

Process to claim 80IAC tax exemption

Step 1: Log in to startup India portal

The first step in claiming a tax deduction is to create your startup India login. Then, you need to apply for DPIIT recognition certificate. You can do so, by following the steps of the startup India registration process.

Step 2: Fill in the details

After logging in to the portal and selecting ‘claim tax exemption’ you need to fill in the form. Name of Startup; Date of Incorporation; Incorporation/registration number; Address and Business location; Nature of Business (whether LLP or PLC); DIPP number; and Contact Details (namely Phone No., E-mail ID, and PAN number of entity).

Step 3: Submit documents required for 80 IAC tax exemption

1. Memorandum of Association (if PLC) 2. Limited Liability Partnership Deed (if LLP) 3. Board Resolution (if any) 4. CA certified balance sheet and Profit and Loss statements; 5. Financial Statements for either the past 3 years or for all the years since incorporation; 6. Income Tax Returns for either the past 3 years or from the date of incorporation; 7. Link to a video pitch of the startup; an 8. Pitch Deck in PDF format.

Conclusion

Once you have submitted the form for section 80 IAC tax exemption, you need to wait for the approval. As a part of the process, the department will go through all the documents and information provided by you, and give an appropriate outcome. As a result of which, the timeline for to get a response or approval from the DPIIT is around 3-9 months. Although, you can keep a track of your application by visiting the startup India portal and clicking on the ‘Dashboard’ of your profile.