Professional Tax Registration

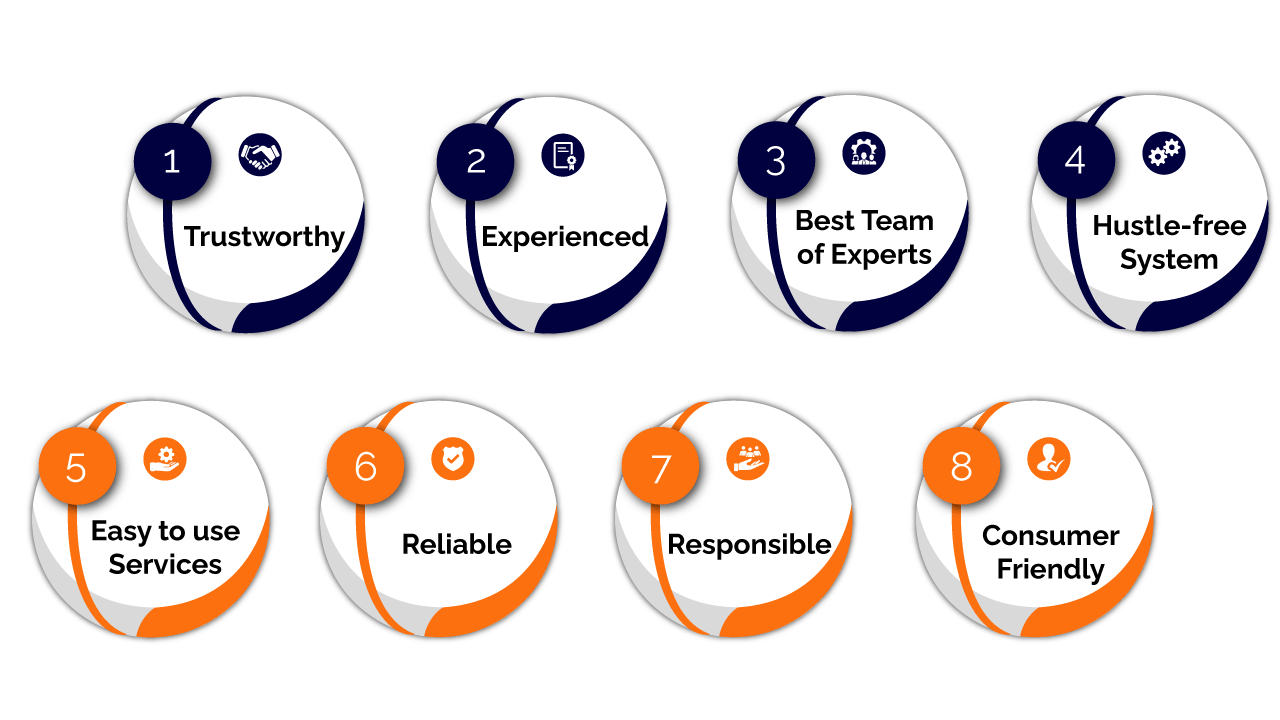

Grow Start Initiate Your Business With Us

Professional tax is a direct tax levied on persons earning an income by either practicing a profession, employment, calling, or trade. Unlike income tax imposed by the Central Government, professional tax is levied by the government of a state or union territory in India.

Start Your Company Without Any Hassel

GNGP Chartered Accountants is an online business compliance platform that helps entrepreneurs and other individuals with various, registrations, tax filings, and other legal matters.

Get Quote Instantly in a Minute

Introduction

Professional Tax Registration Services in India

Professional tax is a direct tax levied on persons earning an income by either practicing a profession, employment, calling, or trade. Unlike income tax imposed by the Central Government, professional tax is levied by the government of a state or union territory in India. In the case of salaried and wage earners, the professional tax is liable to be deducted by the Employer from the salary/wages, and the same is to be deposited to the state government. In the case of other classes of individuals, this tax is liable to be paid by the employee himself. The tax calculation and amount collected may vary from one State to another, but it has a maximum limit of Rs. 2500/- per year

Professional Tax Applicability

- An Individual

- A Hindu Undivided Family (HUF)

- A Company/Firm/Co-operative Society/Association of persons or a body of individuals, whether incorporated or not

Benefits

Benefits of Professional Tax Registration in India

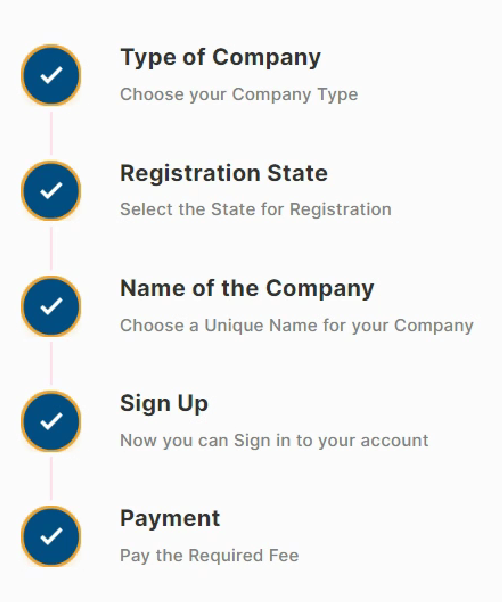

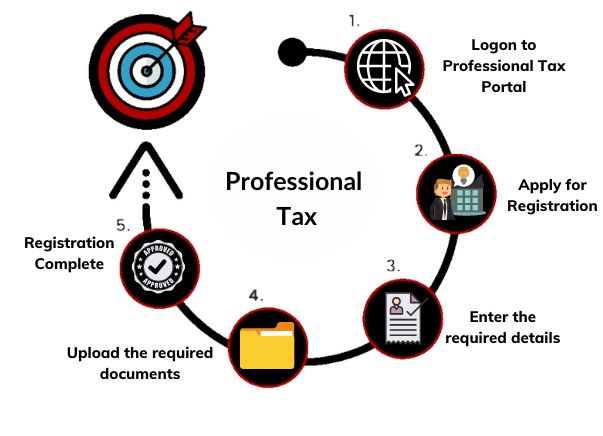

Process

Professional Tax Registration In 5 Easy Steps

Types of Professional Tax Certificates

PTEC (Professional Tax Enrolment Certificate)

This type of professional tax is paid by the business entity, i.e. Private/ Public Limited Company, owner or a professional.

PTRC (Professional Tax Registration Certificate)

The second part of the name should ideally suggest the business activity of the company.

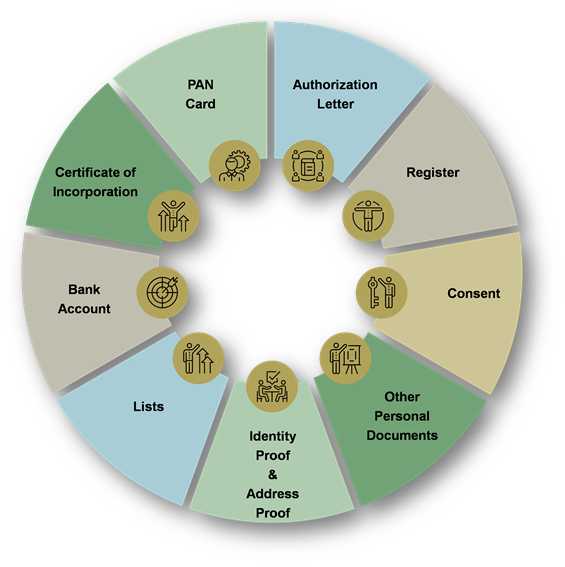

Document Checklist

Documents Required for Professional Tax Registration Online