Microfinance Company Registration

Grow Start Initiate Your Business With Us

Microfinance companies, as the name suggests, are financial institutions that provide finances to low-income groups, where the finance requirement is lesser as compared to other sectors of society.

Start Your Company Without Any Hassel

Get Quote Instantly in a Minute

Introduction

What is a Micro Finance Company?

KEY TAKEAWAYS

- Microfinance is a banking service provided to low-income individuals or groups who otherwise would have no other access to financial services.

- Microfinance allows people to take on reasonable small business loans safely, in a manner that is consistent with ethical lending practices.

- The majority of microfinancing operations occur in developing nations, such as Bangladesh, Cambodia, India, Afghanistan, Democratic Republic of Congo, Indonesia, and Ecuador, among others.

Benefits

Benefits of Micro Finance Company Registration

Promote socio and economic growth

The Micro Finance Company promote socio and economic growth of the economically weaker sections of the society.

Build a financial system for the unemployed

The focus of Micro Finance Company is to build a financial system for the unemployed and poor people of the society.

No need for minimum capital requirements

There is no need for minimum capital requirements if the company is registered as a non-profit Company.

No approval from RBI

Section 8 Company requires no approval from RBI but will follow all the compliances of the Companies Act, 2013.

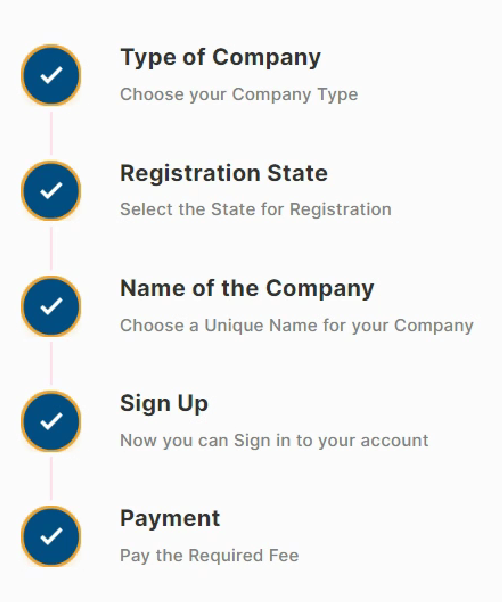

Process

Micro Finance Company Registration In Easy Steps

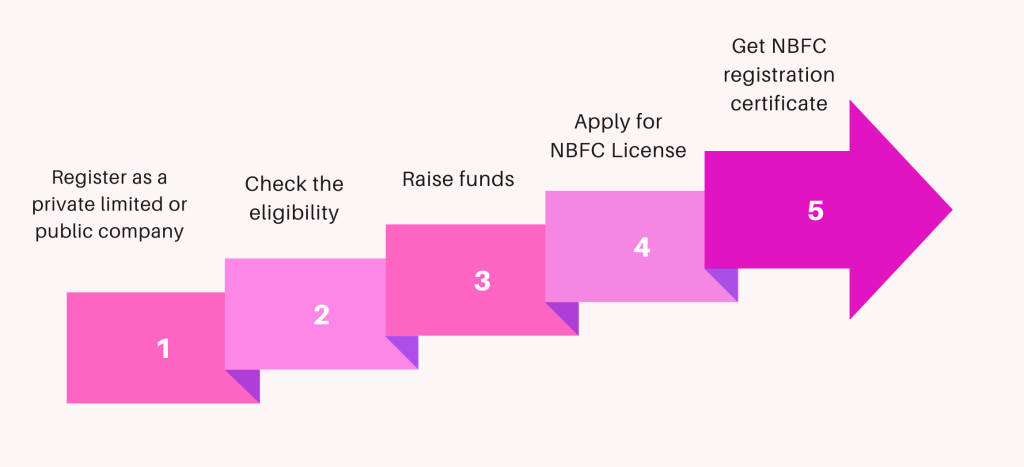

Microfinance Company Registration as an NBFC

Register a company

To be registered as an NBFC microfinance company, the first step is to form a private or a public company.

Raise capital

The subsequent step is to raise the required minimum net owned funds of Rs 5 crore. For the northeastern region the requirement is of Rs 2 crore.

Deposit the capital

On collection of capital, the next step is to deposit the capital in a bank as a fixed deposit and obtain a ‘No lien’ certificate for the same.

Document Checklist

Documents required to Registration

Digital Signature

Digital Signature Certificate (DSC) of Directors;

PAN Card

A copy of PAN of all Directors/Promoters;

Photograph

A latest passport size photographs of all Directors/Promoters.

Address Proof

A copy of address proof like Electricity Bill, Bank Statement, Telephone Bil

Certificate of Incorporation

A true certified copy of the certificate of Incorporation of Company

Copy of Identity

A copy of Identity Proof like Passport, Aadhaar Card, Voter ID.