Income tax Return Filing

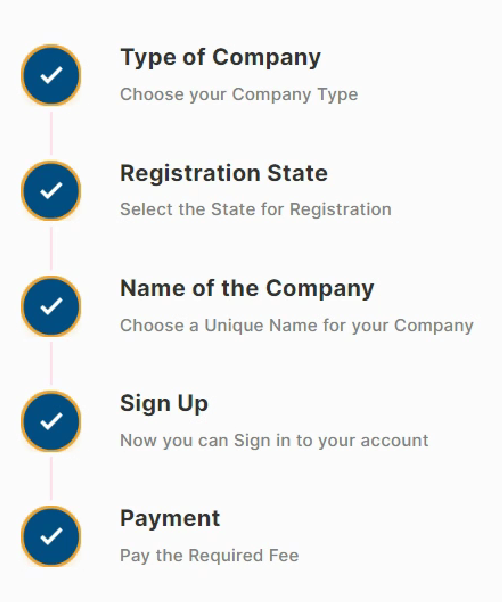

Grow Start Initiate Your Business With Us

The Process to file Income Tax Returns (ITR) by using the internet is called E-filing. The process to e-file ITR is quick, easy, and can be completed from the comfort of an individual’s home or office. E-filing ITR can also help in saving money as you would not have to hire an individual to file ITR.

Start Your Company Without Any Hassel

Get Quote Instantly in a Minute

Introduction

Income Tax Return Filing Services in India

Income Tax Return (ITR) is a form in which the taxpayers file information about their income earned and tax applicable, to the income tax department.

The department has notified 7 various forms i.e. ITR-1, ITR-2, ITR-3, ITR-4, ITR-5, ITR-6 & ITR-7 to date. Every taxpayer should file his ITR on or before the specified due date. The applicability of ITR forms varies depending on the sources of income of the taxpayer, the amount of the income earned, and the category of the taxpayer like individuals, HUF, company, etc.

Why should you file ITR?

- If you want to claim an income tax refund from the department.

- If you have earned from or have invested in foreign assets during the FY.

- If you wish to apply for a visa or a loan

- If the taxpayer is a company or a firm, irrespective of profit or loss.

Benefits

Benefits Of Income Tax Return Filing

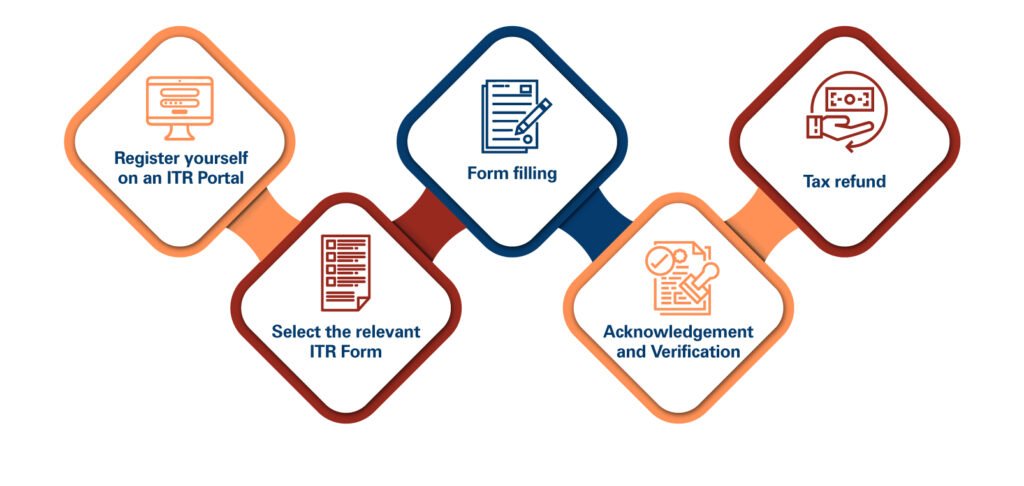

Process

Income Tax Return Filing Process