INC 20A – Commencement Filing

Grow Start Initiate Your Business With Us

Form 20A is a declaration that needs to be filed by the directors of the company at the time of the commencement of the business. It should be verified by a Chartered Accountant (CA) or Company Secretary (CS) or a Cost Accountant in practice.

Start Your Company Without Any Hassel

Get Quote Instantly in a Minute

Introduction

INC 20A – Commencement Filing

INC-20A is a mandatory form that is to be filed by a company incorporated on or after 02/11/2018 with MCA. It is also known as Declaration of Commencement of Business. It should be filed by the directors within 180 days from date of incorporation of a company which has share capital. Once the company receives a certificate of incorporation, the directors will file declaration certificate of commencement of business. It is mandatory to open a current account in a bank for depositing the share capital subscribed in MOA by each and every promoter.

Benefits

Points to make your decision easy

Fund raising

On filing the E-Form INC-20A within 180 days, the company will then be eligible to exercise the borrowing powers. Non filing of which may stop the company from borrowing the money.

Builds Credibility

All the informations relating to the company are made available in a public database. This feature makes it easy to authenticate the existence of the business that ultimately helps in improving business credibility

No penalties

If the company files the form INC-20A within 360 days, the company can be safeguarded from heavy penalties i.e Rs. 50,000 for company & for directors Rs.1000 per day of default up to a maximum of Rs.1 lakh.

Process

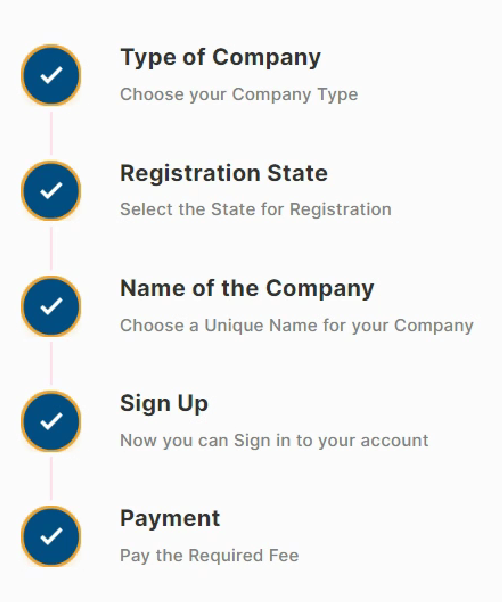

ICA 20A In Easy Steps

Document Checklist

Documents required to filing INC -20A

Proof of payment of subscribed capital

Bank statement/ NEFT / IMPS receipts.

Registration Certificate

Certificate of registration by RBI/ other regulators (applicable to NBFC)