GST Return Filing

Grow Start Initiate Your Business With Us

GST Return filing is mandatory even if there is no transaction during the tax period. Non-filing of NIL Return would attract a penalty from GSTIN. We have a very attractive package for NIL Return filing. Call us to get started.

Start Your Company Without Any Hassel

Get Quote Instantly in a Minute

Introduction

GST Return Filing Services in India

Businesses that are registered under GST have to file the GST returns monthly, quarterly, and annually based on the business. Here it is necessary to provide the details of the sales or purchases of the goods and services along with the tax that is collected and paid. Implementation of a comprehensive Income Tax System like GST in India has ensured that taxpayer services such as registration, returns, and compliance are in range and perfectly aligned.

An individual taxpayer filing the GST returns has to file 4 forms for filing the GST returns such as the returns for the supplies, returns for the purchases made, monthly returns, and the annual returns.

Who should file the GST returns?

- A person having a valid GSTIN has to compulsorily file the GST returns.

- Also, a person whose annual turnover is crossing Rs. 20 lakh has to obtain a GST registration and file the GST returns mandatorily.

- In the cases of Special states, the limit for the annual turnover is Rs.10 lakh.

Benefits

Benefits Of GST Return Filing

GST Return Filing through a Single Form

There are different types of taxes collected under the GST Act, i.e. IGST, CGST & SGST, and all the three taxes paid or collected can now be recorded in a single form.

Better Regulations and Accountability

Before the introduction of GST, the tax filing system was quite unorganized; all the taxes were paid conveniently, and the major inconvenience that was a part of tax filing has now been eliminated.

Start-up Benefits

Before GST, start-ups with an annual turnover of 5 lakh had to pay VAT which was very difficult for a start-up during the initial stages.

Eliminates the Cascading Effect

The introduction of GST into the Indian tax system has removed several other taxes like central excise duty, service tax, customs duty, and state-level value-added tax.

Process

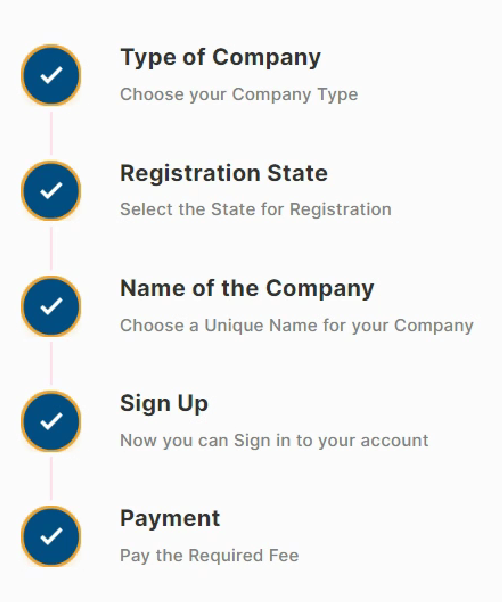

GST Return Filing Process In 6 Easy Steps

Document Checklist

Documents Required for GST Return Filing Online

Invoices

Invoices issued to persons with GSTIN or B2B invoices

Invoices

Invoices issued to persons without GSTIN or B2C invoices

Consolidation

A consolidation of inter-state sales

Id Proof

Basic information such as PAN, Aadhaar card number, and detail of the current address will be required.

Bank Account Details

Bank account details will be required of the given financial year. For ITR filing, it is a mandatory disclosure.

Unique Identification Number

Unique Identification Number and Name of the persons having UIN