GST Registration

Grow Start Initiate Your Business With Us

GST Registration is mandatory for businesses such as Export and Import, E-commerce, Casual Dealers, and also the Market Place Aggregator. Carrying out business without GST registration is considered an offence. Contact us to get this Registration.

Start Your Company Without Any Hassel

Get Quote Instantly in a Minute

Introduction

What is GST Registration?

GST Registration is mandatory for businesses such as Export and Import, E-commerce, Casual Dealers, and also the Market Place Aggregators. Carrying out business without GST registration is considered an offense. Contact us to get this Registration.

The Goods and Service Tax is the biggest indirect tax reform which blends in all the other taxes into one single tax structure. Under GST Regime, goods and services are now taxed under a single law Goods and Service Tax Laws. The taxes are levied at a single rate. The collection is then bifurcated between both the Central and State Governments in the name of CGST and SGST or IGST.

Threshold Limit for Registration

The registration under GST is mandatory for the business entities based on the criteria of turnover or activities. The business dealing in goods and those providing service have to mandatorily apply for GST Registration if their aggregate turnover for a financial year exceeds Rs.40 Lakhs and Rs.20 Lakhs respectively. However, for business making supplies and providing services in the North Eastern States, the same is Rs. 20 lakhs and Rs. 10 lakhs respectively. Owing to its benefits, many dealers also obtain voluntary registration under GST.

The GST registration in India is completely an online process. GST Registration affirms seamless flow of Input Tax Credit in addition to providing recognition as a registered supplier.

Benefits

Benefits of GST Registration in India

Input tax credit and lower cost

In the past small and medium-sized businesses have faced various hurdles while trying to get loans from banks. However, udyam registered businesses can get easy and collateral-free loans from banks and financial institutions. Additionally, loans are offered at a subsidized rate of interest to MSME registered businesses.

Legally recognized as Supplier

With compulsory or voluntary registration under GST, the supplier is eligible to collect the taxes legally. Further, the supplier can also pass on the credit. The voluntary registrant also gets equal status and responsibilities of taxpayer registered under the mandatory criteria. With the said registration, the registrant can also issue pakka invoice to the consumers.

Simplified and permanent registration

The online registration process is simplified with the assistance from LW experts. With the completion of registration process, the certificate is granted to the applicant stating the GST registration number, which is called GSTIN. The registration granted is permanent registration without any renewal requirement.

Easy compliance requirements

Upon registration, every registrant is liable to fulfil compliance in the form of return filing in a periodical manner. These compliance requirements are simplified under the GST regime. It is also proposed to simplify the compliance through single return filing from multiple filings. A regular taxpayer would be awarded a higher GST Compliance rating as compared to others.

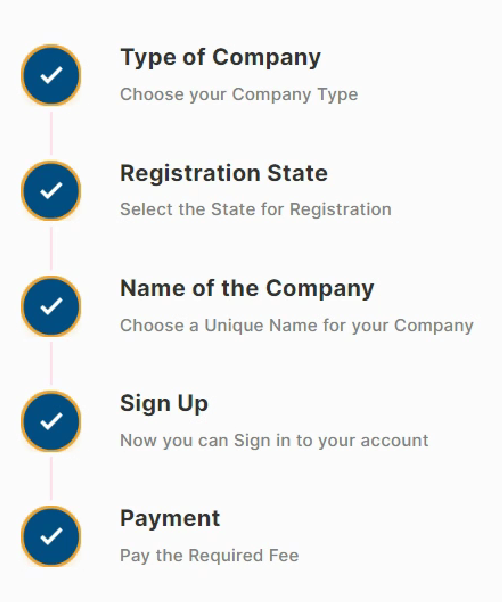

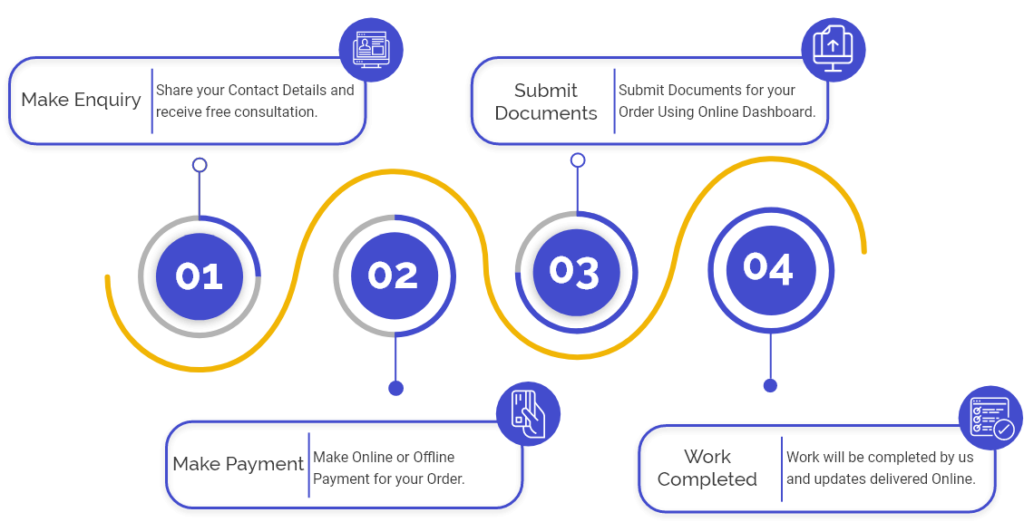

Process

Process To Get GST Registration

Document Checklist

Documents Required for GST Registration

Digital Signature

DSC of Partners or Directors, in case of LLP and Company only

PAN & Aadhar Card

A copy of Aadhar Card of Proprietor/ Partners/ Directors

Bank details

Latest Bank Statement/ Copy of cancelled cheque/ copy of first page of passbook

Photograph

Copy of passport size photograph of the Proprietor/ Partners /Directors

Business Address Proof

Latest Electricity bill/ Any Tax paid bill/ Municipal Khata Copy

Rent Agreement

If place is rented, rent agreement is mandatory, else consent letter is sufficient