ESI Registration

Grow Start Initiate Your Business With Us

Employee State Insurance Registration is applicable to all the companies with having more than 10 employees drawing a maximum monthly salary of Rs. 21000/-. ESI Registration is to be done with Employee State Insurance Corporation who manages and offer various medical and monetary benefits to these employees.

Start Your Company Without Any Hassel

Get Quote Instantly in a Minute

Introduction

What is ESI Registration

Employee’s State Insurance (ESI) Scheme runs under an independent authority- Employee State Insurance Corporation which falls under the jurisdiction of the Ministry of Labour & Employment. This scheme is designed to provide socio-economic protection to employees working in a company. Medical benefits, sickness benefits, maternity benefits, and various other benefits to employees and their families are covered under this scheme. The scheme also extends financial assistance and medical care to the employees along with their family members insured under ESI Act. The employer and employee need to contribute to the ESIC and hence, it can be called a self-financing scheme. The employer needs to register under the ESI Scheme which can be taken online at www.esic.nic.in (Government portal) once the employer falls under the obligation of taking this registration.

Check whether your entity is covered under ESIC: (having more than 10 employees)

- Non-Seasonal factories employing more than 10 employees

- Shops

- Hotels

- Restaurants

- Cinemas including preview theatres

- Road-motor transport undertakings

- Non-Banking Financial Companies

- Port Trust

- Airport Authorities

- Warehousing establishments

- Private Medical Institutions, Educational institutions and

- Road-motor transport undertakings

Why Get ESIC?

Benefit of ESIC

Medical Assistance

The scheme provides the medical assistance and treatment to the insured person covered under this said act along with his/ her families as and when required. The benefit is given in kind by the state government through Model Hospitals run by ESIC (except in Delhi) without linking to employee’s wages and contributions.

Impairment Benefits

Disabled employees can get are eligible for getting 90% of their monthly salaries as disablement benefits.

Dependent Assistances

During the employment tenure, in case of sudden death of the employee, the dependants of the deceased employee will receive 90% of his/her monthly salary.

Maternity Benefit

This benefit is designed for Pregnant women to whom the benefits are payable up to 26 weeks. The said period can be extended by 30 more days on medical instruction. To enjoy the benefit, employees are required to contribute their wages/ salaries for 70 days in the preceding 2 contribution periods.

Sickness Aids

With 70% of the monthly wage, absence from work due to illness can be taken for a maximum of 91 days per year

Cremation Expenses

An additional amount of Rs.10,000 towards funeral expenses is provided to the family of the deceased employee.

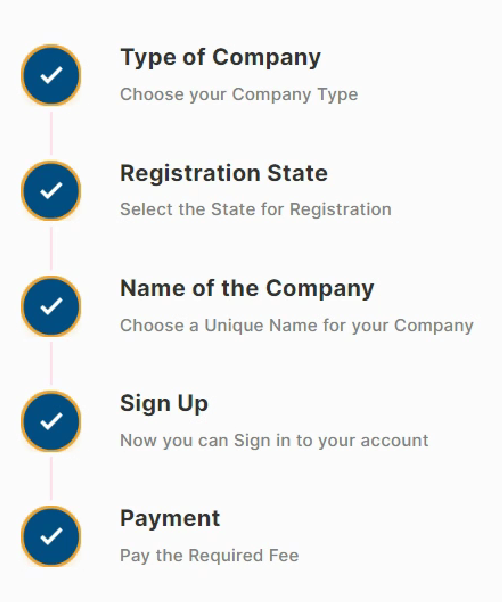

Process

ESIC Registration Process In Easy Steps

Filing dates for ESI

Payment: 15th of every month

Payment: 15th of every month

Filing dates for PF

Payment: 15th of every month

Payment: 15th of every month

Documents required

Documents required for ESI Registration